Those calling for one of Massachusetts’ big health care chains to buy such troubled Steward Health Care-owned hospitals as Holy Family may take pause hearing a consumer group’s concern that consolidation contributes to rising costs.

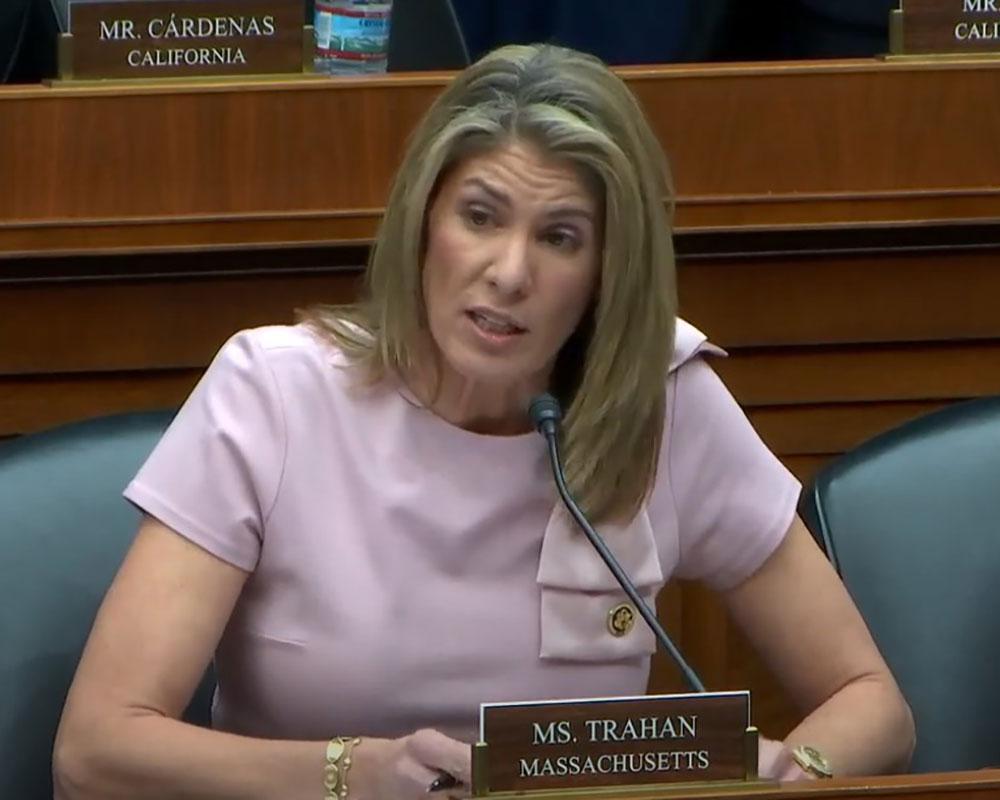

Families USA Senior Director of Health Policy Sophia Tripoli told Congresswoman Lori Trahan and a congressional subcommittee Wednesday that “trends in health care industry consolidation across the U.S. …have eliminated competition and allowed monopolistic pricing to flourish.” Trahan discussed the effect on Steward’s patients locally.

“Their care is now in jeopardy because of the corporation’s gross financial negligence that seen the company try to shutter four of the nine hospitals they own in Massachusetts,” she said.

Tripoli told Trahan her group endorses bipartisan-backed bills in Congress that require greater transparency.

“That would not only allow us to have a better sense of the trends that are happening in the market around mergers and acquisitions related to private equity. We can identify other types of anti-competitive practices that are going on and we can empower state and federal regulators with important information to scrutinize the role of private equity in health care mergers and acquisitions.”

Tripoli blamed “escalating prices, which are the result of hospitals buying other hospitals and community doctors to eliminate competition and form big health care corporations and medical monopolies.”

Greater Haverhill may be indicative of such consolidation over recent years with mega nonprofits Mass General Brigham buying the formerly locally owned Pentucket Medical Associates and Beth Israel Lahey Health buying Anna Jaques Hospital and related medical property in Haverhill.

Trahan, a member of the House Energy and Commerce Committee’s Health Subcommittee that questioned Tripoli, noted community hospitals have faced “significant financial challenges” over the years.

“Challenges that were deepened by the pandemic and, in some cases, are being made even worse by a private equity model that puts profits squarely above our patients and their care,” she said.

Trahan took particular aim at what she called the “dangerous Steward private equity playbook.” She said investors try to look profitable while they try to sell out in three to five years. She said the “real estate underneath is much more profitable than the institution itself.”

The congresswoman told the story of how in 2017 Steward bought Texas Vista Medical Center in San Antonio “with the help of private equity.” As they did locally, Medical Properties Trust purchased the land and buildings, charged $5 million in rent which was followed by Steward announcing the hospital’s closing. “Mr. chairman, this is what the disastrous reality of private equity in our health care system looks like. And, the thing is. It’s happening again, but this time families in my district are the ones being told that they have to pay the price.”

Tripoli backed the PATIENT Act, which stands for Promoting Access to Treatments and Increasing Extremely Needed Transparency, which the committee advanced in May 2023 and the Lower Costs, More Transparency Act, which passed the House.